Jun 13, 2022

Why Did I Receive a Non-Renewal?

Have you received a notice from your insurance company, informing you they won’t be renewing your contract this year? Here are a few possible reasons why that may be happening.

When owning a home, one of the key necessities is having Homeowners Insurance.

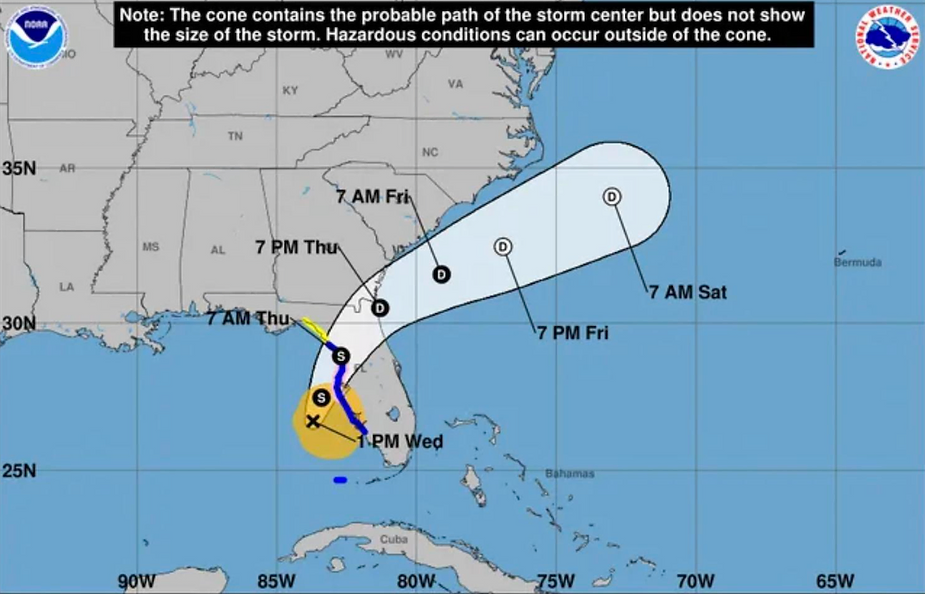

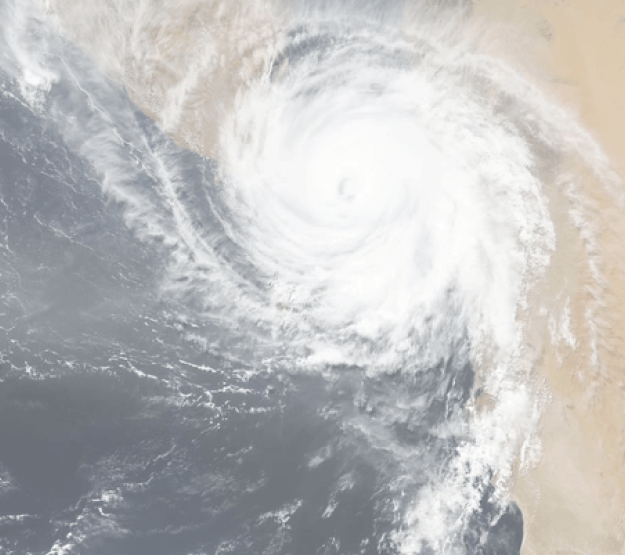

It’s really not mandatory when you own the home free and clear, however if you’re under a Mortgage Lenders they will require you to have a policy to protect their interest. It is better to have it and not needed it, then to need it and not have it. Insurance policies should provide peace of mind in the case that damages or losses occur due to events such as Hurricanes, storms, fires and theft.

You are sold on the idea and promised that you are covered for a, b, c and d, while having some exclusions.

Not to mention, that you pay premiums with the intention of confidently knowing they will help you cover the damages or losses caused by the unforeseen events recently mentioned above.

Now, what happens when you’re a loyal customer for many years and never filed a claim while holding the policy but you happen to get a notice stating that they will not renew your policy this time around?

Confused, you then ask yourself, “why are they doing this?”

Before getting into the possible truth of why they do this you must understand the following.

It’s really not mandatory when you own the home free and clear, however if you’re under a Mortgage Lenders they will require you to have a policy to protect their interest. It is better to have it and not needed it, then to need it and not have it. Insurance policies should provide peace of mind in the case that damages or losses occur due to events such as Hurricanes, storms, fires and theft.

You are sold on the idea and promised that you are covered for a, b, c and d, while having some exclusions.

Not to mention, that you pay premiums with the intention of confidently knowing they will help you cover the damages or losses caused by the unforeseen events recently mentioned above.

Now, what happens when you’re a loyal customer for many years and never filed a claim while holding the policy but you happen to get a notice stating that they will not renew your policy this time around?

Confused, you then ask yourself, “why are they doing this?”

Before getting into the possible truth of why they do this you must understand the following.

Insurance Companies profit by denying claims and NOT paying you because let’s’ face it, it’s a business.

Did you know, Insurance Companies enjoy average profits of over $30 billion a year? Insurance companies will engage in dirty tricks and unethical behavior to boost their bottom line.They spend billions on advertising to earn your trust only to eventually drop you, deny claims, delay payments, confuse consumers with insurance-speak, and refuse anyone who may cost them money. This is why it’s important to understand clearly what your insurance contract states and what you are covered for. Therefore if you decide to open a claim, you are highly recommended to hire a professional like a Public Adjuster to help facilitate your needs and answer questions as they work for you and not the Insurance companies. deceptive.

Did you know, Insurance Companies enjoy average profits of over $30 billion a year? Insurance companies will engage in dirty tricks and unethical behavior to boost their bottom line.They spend billions on advertising to earn your trust only to eventually drop you, deny claims, delay payments, confuse consumers with insurance-speak, and refuse anyone who may cost them money. This is why it’s important to understand clearly what your insurance contract states and what you are covered for. Therefore if you decide to open a claim, you are highly recommended to hire a professional like a Public Adjuster to help facilitate your needs and answer questions as they work for you and not the Insurance companies. deceptive.

Now back to the topic.

Here are some possible reasons why they might drop you or plan too.

Usually Insurance Companies are well informed about certain details of your home. An example would be; them knowing how old certain appliances are or the conditions of certain parts and areas of your property.

For instance, they are fully aware that your roof might be 10-15 years old causing it to be susceptible to storm damage. So, if the state you reside in gets hit by a strong storm, you will most likely need to open a claim to cover damages caused by it. Therefore they might drop you before you can even make it that far. In some cases they might require you to replace your entire roof out of pocket to avoid getting dropped. Which when looking at it from a broader perspective seems very unfair and

Here are some possible reasons why they might drop you or plan too.

Usually Insurance Companies are well informed about certain details of your home. An example would be; them knowing how old certain appliances are or the conditions of certain parts and areas of your property.

For instance, they are fully aware that your roof might be 10-15 years old causing it to be susceptible to storm damage. So, if the state you reside in gets hit by a strong storm, you will most likely need to open a claim to cover damages caused by it. Therefore they might drop you before you can even make it that far. In some cases they might require you to replace your entire roof out of pocket to avoid getting dropped. Which when looking at it from a broader perspective seems very unfair and

If this is your situation, we encourage you to reach out to a Public Adjuster to review in great detail your current policy.

Other reasons could be Discrimination of Credit.

Recent studies indicate that, Insurance Companies are using credit reports to dictate the premiums consumers pay. Few Americans realize that their credit history can affect their insurance premiums or whether they can even get insurance in the first place. Credit-scoring disproportionately disfavors minorities, the poor or the elderly person who has been accustomed to paying everything on time by using cash.

This is another possible reason or tactic used to send you a Non-renewal notification.

Also, another common reasons could be that the Insurance company is going out of business and has filed bankruptcy.

So now what?

Other reasons could be Discrimination of Credit.

Recent studies indicate that, Insurance Companies are using credit reports to dictate the premiums consumers pay. Few Americans realize that their credit history can affect their insurance premiums or whether they can even get insurance in the first place. Credit-scoring disproportionately disfavors minorities, the poor or the elderly person who has been accustomed to paying everything on time by using cash.

This is another possible reason or tactic used to send you a Non-renewal notification.

Also, another common reasons could be that the Insurance company is going out of business and has filed bankruptcy.

So now what?

Contacting your local Public Adjuster to provide proper guidance is always in your best interest.

They can help you determine what actions you could and should take with your unique circumstances. Even if you’re being dropped, contact your local Public Adjuster to provide you with a free consultation. They will be the best professional to ask questions regarding which direction to take and what insurance companies and policies they recommend. Including what to look out for when shopping around for a new policy. Remember that a Public Adjuster works for you and since most Public Adjuster get paid on a contingency basis (they get paid when you get paid), they will fight hard to get you the largest payout possible!

This could ultimately work in your favor and you should not be discourage to call an Adjuster for a free consultation. Our advice is, don’t worry and take action when you receive a Non-renewal notice!

They can help you determine what actions you could and should take with your unique circumstances. Even if you’re being dropped, contact your local Public Adjuster to provide you with a free consultation. They will be the best professional to ask questions regarding which direction to take and what insurance companies and policies they recommend. Including what to look out for when shopping around for a new policy. Remember that a Public Adjuster works for you and since most Public Adjuster get paid on a contingency basis (they get paid when you get paid), they will fight hard to get you the largest payout possible!

This could ultimately work in your favor and you should not be discourage to call an Adjuster for a free consultation. Our advice is, don’t worry and take action when you receive a Non-renewal notice!

RELATED ARTICLES

How to Get Insurance Claims Approved for Roof Damage

September 8, 2022

It’s that season

July 22, 2022

What Damages Does a Public Adjuster Handle?

April 11, 2022